Who Is Spending? Canadian Household Debt

Canadian consumer debt has continued to rise over the last few months, and although the delinquency rate has dropped, the spending has not. But since the delinquency rate has dropped, that means that individuals are more conscious of the need to keep up with paying off Canadian household debt – which is always a good thing.

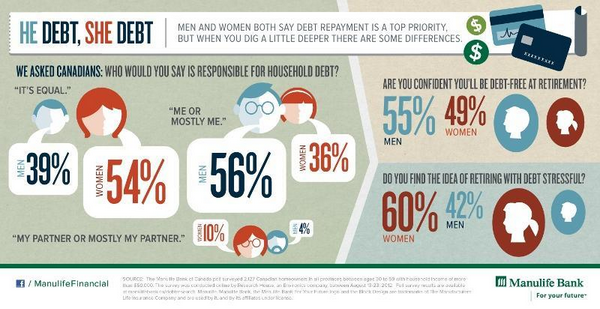

So who is spending, who is responsible for dealing with household debt, and how do Canadians feel about their retirement financials? Check out this great infographic “He Debt, She Debt.”

According to the survey, both men and women say debt repayment should be a top priority, but there were a few interesting findings:

- Who is responsible for household debt?

- It is equal: 39% men vs. 54% women

- Me or mostly me: 56% men vs. 36% women

- My partner or mostly my partner: 4% men vs. 10% women

- Are you confident you’ll be debt-free at retirement?

- 55% of men and 49% of women said yes

- Do you find the idea of retiring with debt stressful?

- 60% of women and 42% of men said yes

Where do you stand as far as these survey results? Are you the big spender in your household? Do you feel as though retiring without debt is a feasible achievement?

If Canadian household debt seems to be a stressor, no matter who is responsible, or if you feel like retiring without debt might be an impossible goal, please call DebtCare Canada today. We can help you deal with your debt problem and get you back on a firm financial footing: 1-888-890-0888.